palm beach county business tax receipt phone number

Palm beach county tax collector attn. This requirement includes one-person and home-based businesses.

Tourist Development Tax Constitutional Tax Collector

Box 3353 West Palm Beach FL 33402-3353.

. Business Tax Department PO. This Tax Receipt expires on the date shown. Get a short-term Business Tax Receipt BTR number.

Information pertaining to Zoning Use Permits Brevard County Zoning 321-633-2070. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. Business Tax Office 386 986-3766 Code Enforcement 386 986-3764 Communications Marketing 386 986-3708 Finance 386 986-3723 Human Resources 386 986-3718 Fire Non-Emergency 386 986-2300 Purchasing 386 986-3730 Parks Recreation 386 986-2323.

BUSINESS TAX APPLICATIONCERTIFICATE OF USE. You can reach the Palm Beach County Planning and Zoning Office at 561-233-5000 if you need assistance. Palm Beach County Tax Collector Attn.

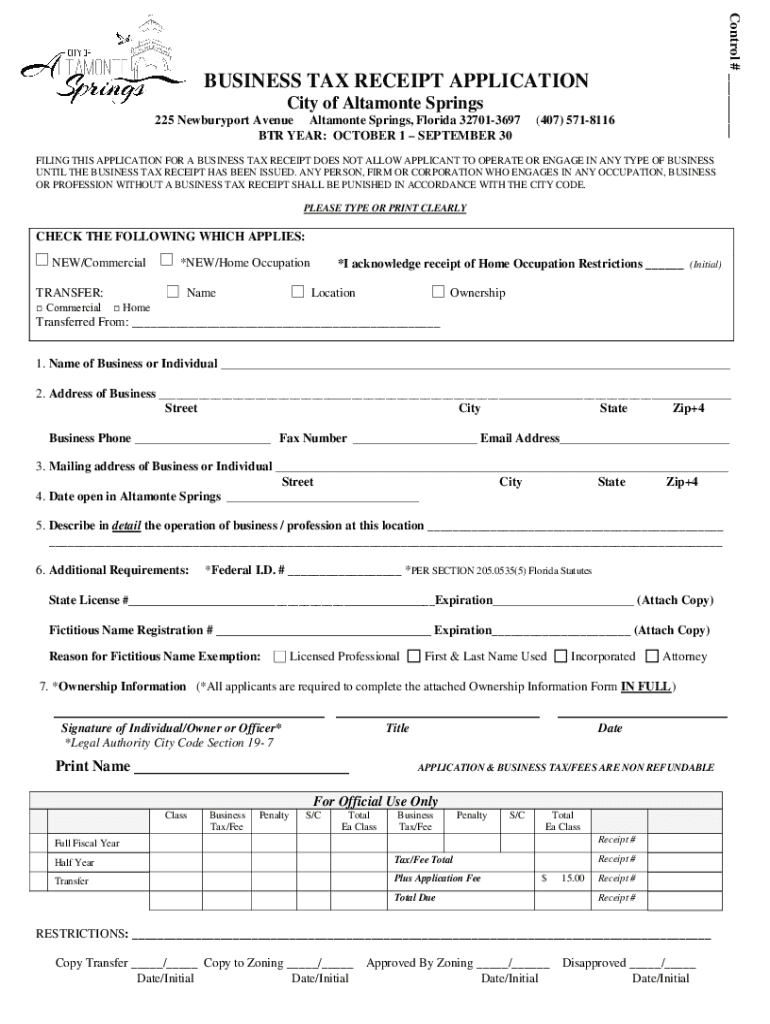

Service Core of Retired Executives SCORE Phone. THIS APPLICATION IS NOT A BUSINESS TAX RECEIPT OR CERTIFICATE OF USE. Requirements for a business located within a municipality contact the City.

Contact Numbers for Information. This application is not a business tax receipt or certificate of use required fields pcn. If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264.

Palm Beach County Tax Collector Attn. Box 3353 West Palm Beach FL 33402-3353. IRSC Small Business Development Center Phone.

Our mission is to deliver the highest quality service and support to the Palm Beach business community with excellence integrity and efficiency. The Palm Beach County Occupational License Office is located at 561-355-2272. County Line Ad Contract and Deadlines.

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. 17 digit Parcel Control Number can be found on Palm Beach County Property Appraiser PAPA website at. 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

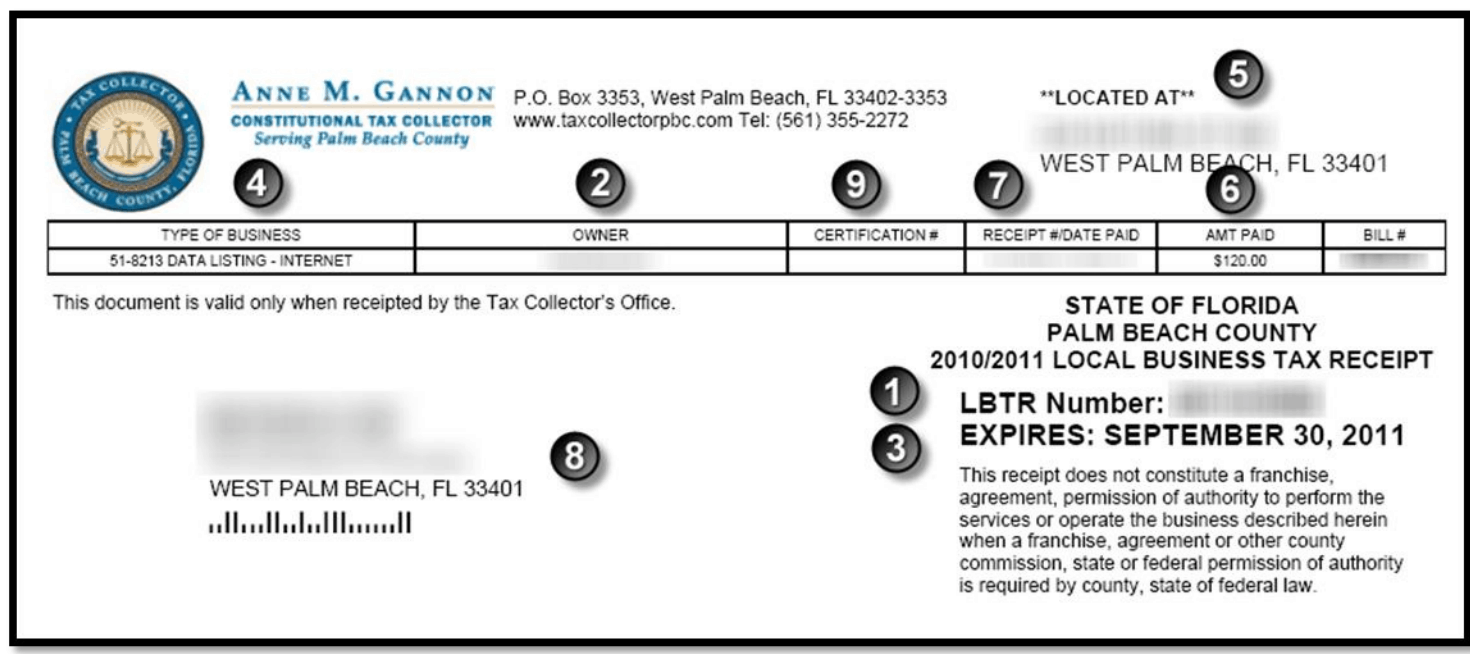

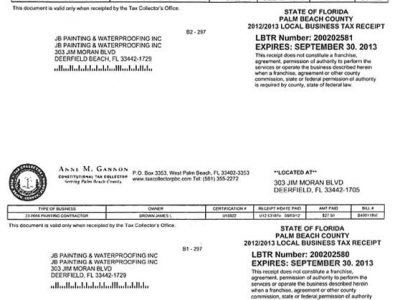

1050 Royal Palm Beach Blvd. Tax Receipt Sample. Mail completed application to.

Box 3715 West Palm Beach FL 33402-3715. 800 829-4933 Tax ID Number. 561 227 - 6411.

Business Tax Receipt. The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode. Business Tax Department PO.

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. If you want to open a home business in your town you may be able to do so but make sure you check the license s you need first. Your TDT account number from Step 1.

Palm Beach FL 33480. Economic Council of PBC. A business tax receipt is a tax levied upon all businesses within the municipal boundaries.

360 South County Road. There may be other requirements in order to issue your business tax receipt. Please refer to this number when making inquiries.

Box 3353 West Palm. Contact the Tax Collectors at 561-233-355-2264 or visit the website at. There may be other requirements in order to issue your business tax receipt.

If you have questions or require assistance please call 561 355-3547 to speak with a TDT client service specialist Monday through Friday 815 am. Toll Free 888-852-7362 Fax. Mail completed application to.

5 per month will be charged on past due accounts-18 per year. 4 rows Palm Beach County Tax Collector Attn. 401 clematis street west palm beach florida 33401 phone.

Jog road west palm beach florida 33411 phone. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. 561-355-2264 9 hours ago Constitutional Tax Collector Serving Palm Beach County PO.

Payment of the tax receipt does not certify or imply the. If this is NOT correct contact the Tax Collectors office at 561 355-2272. Fort Pierce City Clerk Phone.

Business Tax Department PO. Tax Planner Services Guide Annual Report to Our. Box 3353 West Palm Beach FL 33402-3353.

Lucie City Hall Phone. Box 3715 West Palm Beach FL 33402-3715. Lucie county obtain a county business tax receipt.

For more information on licensing. Allow 7 to 10 business days to process. 561-712-6600 Boca Delray Glades.

This is a unique number assigned to each business. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX. Business Tax Department PO.

What the Tax Receipt Is. Royal Palm Beach FL 33411 Map. Constitutional Tax Collector Serving Palm Beach County PO.

50 South Military Trail Suite 201 West Palm Beach FL 33415 West Palm Beach Area. All businesses and professional offices within the Village must also obtain a Business Tax Receipt from Palm Beach County. Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

You can also send us a message and one of dedicated team members will get back with you visit Tourist Development Tax Contact to send us a message. FOR OFFICE USE ONLY.

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Permit Source Information Blog

Local And County Tax Receipt Laws In Palm Beach County

Permit Source Information Blog

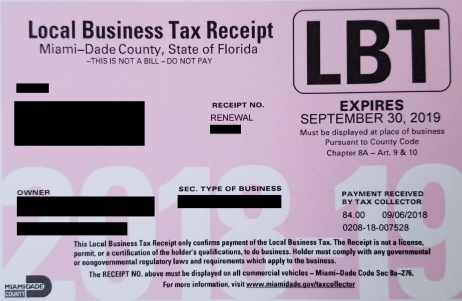

Miami Dade County Local Business Tax Receipt 305 300 0364

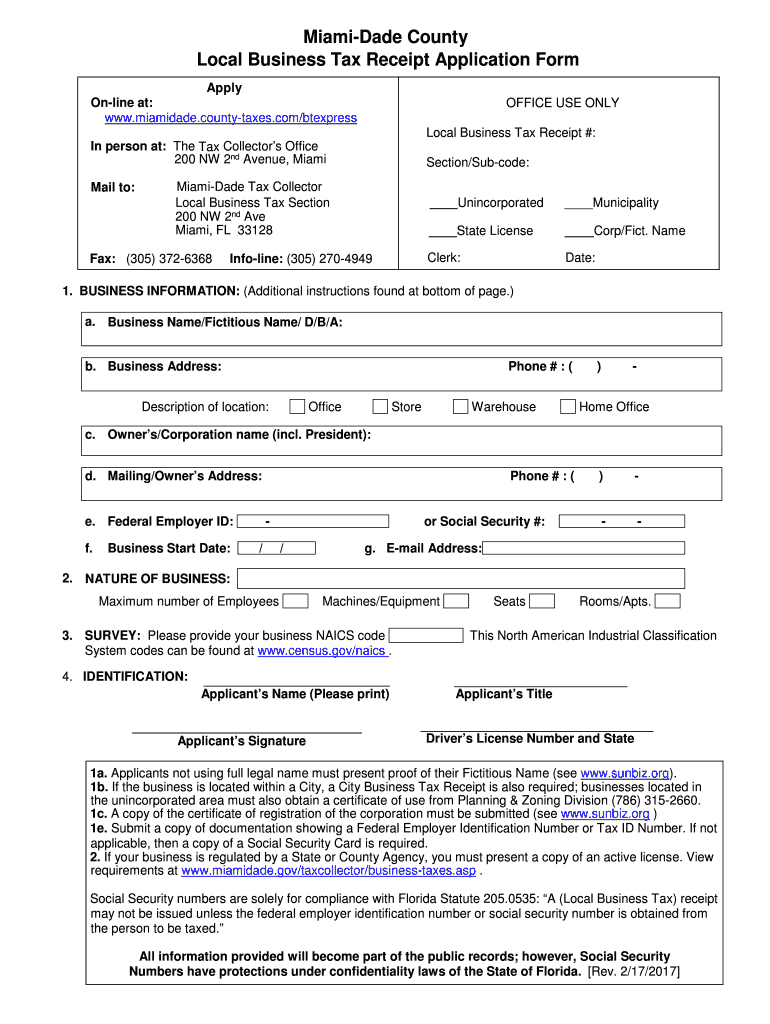

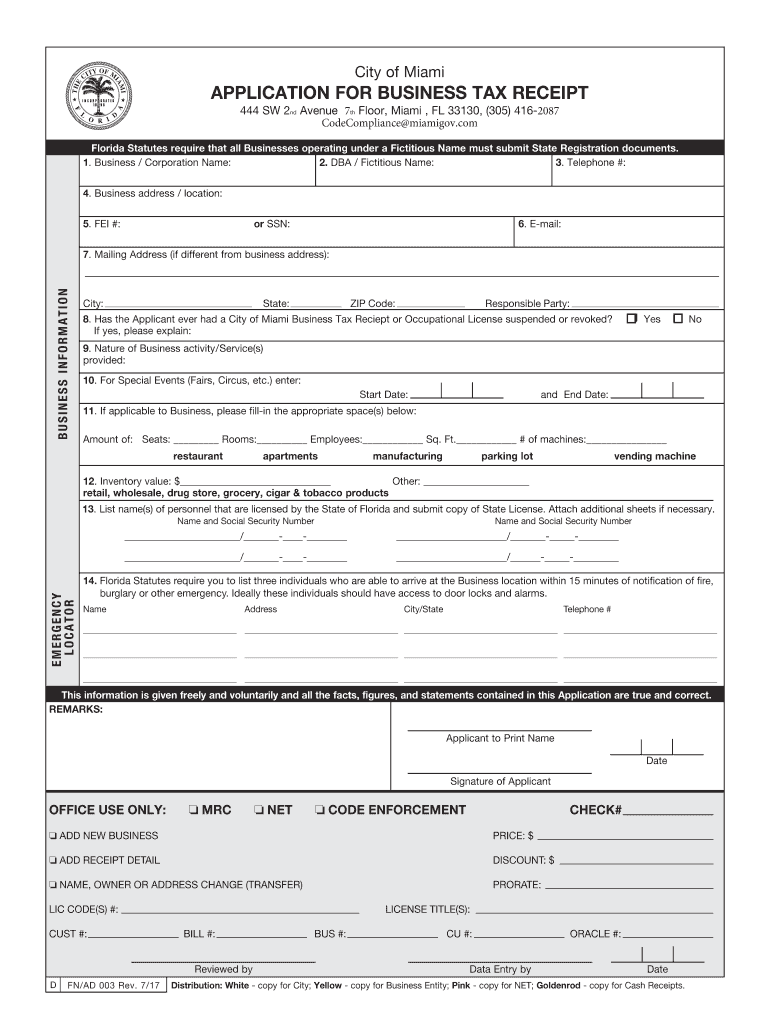

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

Palm Beach County Local Business Tax Receipt 305 300 0364

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

West Park Area Broward County Local Business Tax Receipt 305 300 0364